The geared motors and industrial gears market experienced a decline in 2023 following strong growth in 2022. According to global market intelligence company Interact Analysis, further market contraction is expected in 2024 before recovering in 2025. For the 4th edition of the Geared Motors & Industrial (Heavy-duty) Gears Market report, Interact Analysis has conducted interviews with leading vendors in the industry to capture market performance, trends and development

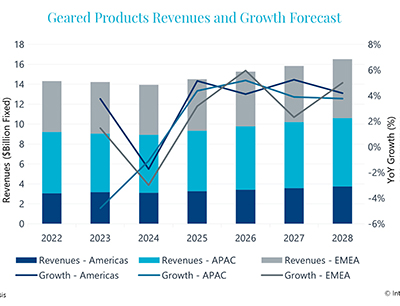

Interact Analysis’ latest research found that many gearbox suppliers observed a slowdown in order intake in the second quarter of 2023, leading to an expected market revenue contraction of 0.7 percent. This dip is expected to continue into 2024, leading the company to forecast a further revenue decline of minus 1.9 percent for the geared motors and industrial gears market next year. However, the outlook appears to be rosier for 2025 and beyond, with steady growth for geared products expected of about three to five percent per year out to 2028.

Despite a slow year for the market in 2023, the global geared products market was worth $12.6 billion in 2022, representing year-on-year growth of 1.4 percent. Price increases played a significant role, as average selling prices of geared products rose by five to ten percent in 2022 fueled by raw material costs, supply chain problems and rising energy prices.

Taking a look at the market by region, Asia Pacific (APAC) is by far the largest for geared products, representing 46 percent of global revenues. This is followed by EMEA and the Americas with shares of 33 percent and 21 percent respectively. Revenue growth in the Americas outpaced EMEA in 2022 as a result of strong demand and strong currency. The market in the Americas grew by twelve percent in 2022, compared with just one percent in EMEA and minus 2.7 percent in Asia Pacific. However, in 2023, the APAC region is expected to have experienced the largest contraction, while the Americas region is forecast to maintain reasonable growth. This decline in APAC is largely due to the contraction that has been observed in China and the impact of the property slump on this market. It is expected that Indian and Southeast Asian markets will prop up revenue growth of geared products in APAC over the next couple of years.

Samantha Mou, Research Analyst at Interact Analysis, comments on the supplier landscape for the geared products market, stating, “The leading vendors for the geared products market remain relatively unchanged, but concentration of the supplier base continues. As a result of its acquisition of Altra Motion, Regal Rexnord is now among the top 5 leading global suppliers of geared products. “Overall, the ranking of other leading vendors remains stable, with SEW-Eurodrive retaining its position as the #1 vendor globally and across all tri-regions. The EMEA vendor landscape is the most ‘stable’, with all leading suppliers enjoying growth in their specialized areas in 2022.”